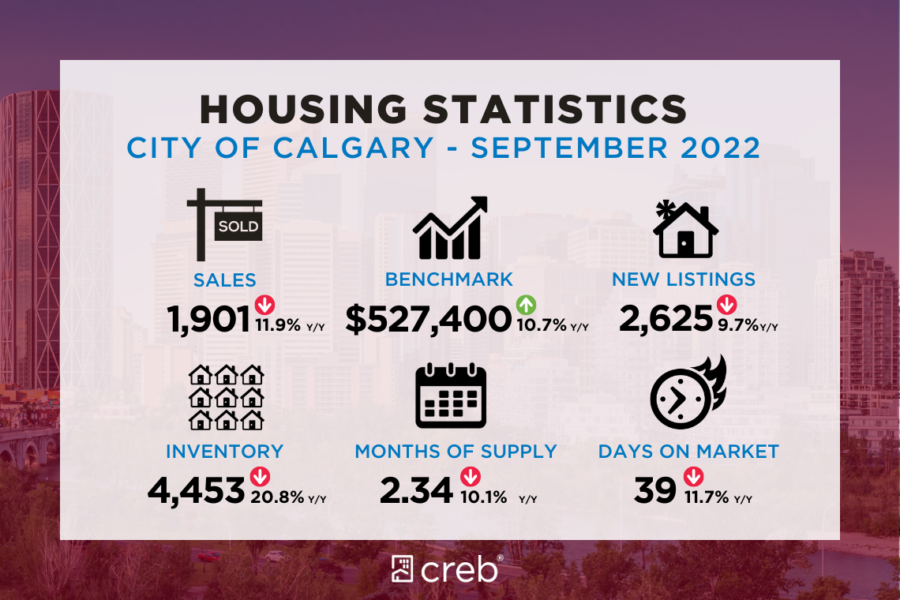

| Strong sales for condominium apartment and row properties was not enough to offset declines reported for other property types. This caused city sales to ease by nearly 12 per cent compared to last year.

However, with 1,901 sales in September, activity is still far stronger than levels achieved prior to the pandemic and is well above long-term trends for September. Despite recent pullbacks in sales, and thanks to strong levels earlier in the year, year-to-date sales remain 15 per cent higher than last year’s levels.

“While demand is easing, especially for higher priced detached and semi-detached product, purchasers are still active in the affordable segments of the market, cushioning much of the impact on sales,” said CREB® Chief Economist Ann-Marie Lurie. “At the same time, we are seeing new listings ease, preventing the market from becoming oversupplied and supporting more balanced conditions.”

In September, new listings declined by ten per cent. With a sales-to-new-listings ratio of 72 per cent, it was enough to prevent any gain in inventory levels, which declined over last month and were nearly 21 per cent lower than last year’s levels. The adjustments in both sales and supply levels have caused the months of supply to remain relatively low at less than three months.

The shift to more balanced conditions is causing some adjustments to home prices. While prices have slid from the highs seen in May, as of September, benchmark prices remain 11 per cent higher than last year and six per cent higher than levels reported at the beginning of the year.

Detached

For the sixth consecutive month, sales activity has slowed in the detached market and is now offsetting the gains recorded in the first quarter. The recent decline in sales has been mostly driven by a reduction in the under $500,000 segment of the market, as a significant reduction in supply for those price ranges have left little options for potential purchasers.

At the same time, detached sales continue to improve for homes priced between $600,000 – $999,9999. This higher price range group has reported the largest growth in new listings and overall supply levels.

While the overall detached market is far more balanced than it was earlier this year, for homes priced below $500,000 conditions remain relatively tight. This is likely causing divergent trends in pricing activity based on price range.

Overall, detached prices eased by nearly one per cent over the last month with the largest monthly decline occurring in the City Centre district. Despite monthly adjustments, prices remain nearly 13 per cent higher than last year.

Semi-Detached

Further pullback in sales this month was not enough to offset gains from earlier in the year as year-to-date sales remained six per cent higher than last year’s levels. While new listings in this segment can vary month-to-month, year-to-date new listings have remained just slightly lower than levels achieved last year. This kept inventories at levels that are still far below long-term trends.

The recent pullback in sales was enough to cause the months of supply to push up relative to levels seen earlier in the year. However, with less than three months of supply, conditions remain relatively tight for this property type.

While conditions do remain tight, prices still trended down following higher than expected gains earlier this year. Overall, benchmark prices remain over 10 per cent higher than levels reported last year.

Row

Row sales activity improved over last year’s levels, contributing to the year-to-date record high pace of sales. Recent pullbacks in new listings and strong sales activity have caused inventory levels to remain low, keeping the months of supply below two months.

With conditions remaining tight, prices stay mostly unchanged compared to last month and are 15 per cent higher than prices reported in September 2021. The highest year-over-year price gains occurred in the North district.

Apartment Condominium

With a new September record, apartment condominium sales continue to rise relative to last year, contributing to year-to-date sales of 5,026, a 60 per cent gain over last year. While new listings also improved so far this year, it has not been enough to prevent some easing in inventory levels.

Unlike the other sectors, since 2016, inventories have generally been higher for apartment condominium. It is only the strong demand this year that has caused this market to shift from buyers’ market conditions reported throughout most of last year to one that is now relatively balanced.

Relatively balanced conditions prevented any significant shift in prices this month compared to last month and overall, apartment condominium prices remain over 10 per cent higher than last year’s levels. Despite recent gains, prices remain below the 2014 high.

REGIONAL MARKET FACTS

Airdrie

Both sales and new listings eased in September, preventing any significant shift in inventory levels this month. With a sales-to-new-listings ratio of 89 per cent and a months-of-supply still below two months, conditions remain relatively tight in the market.

While inventory levels remain low, purchasers are more cautious than they were a few months ago which is weighing on home prices. In September, the benchmark price eased by nearly two per cent compared to last month but remains 16 per cent higher than the previous year.

Cochrane

Sales eased for the sixth consecutive month in September. This caused year-to-date sales to reach 970 units, a three per cent decline over the previous year. At the same time, new listings have risen relative to the low levels seen last year, helping support gains in inventory levels.

As of September, there were 165 units available in inventory. While this is higher than last year’s levels, this is still nearly 30 per cent lower than levels traditionally seen in September.

Shifts in both supply and demand are causing the market to shift toward more balanced conditions and it is also taking some of the pressure off home prices. In September, the benchmark price eased by nearly two per cent, totaling to $508,800. Despite the monthly pullback, prices are still over 16 per cent higher than September 2021 prices.

Okotoks

Supply levels continue to be a challenge in Okotoks. While new listings have improved over last year, sales have generally kept pace as the sales-to-new-listings ratio remained elevated at 81 per cent. At the same time, inventories remain nearly 50 per cent lower than levels traditionally seen in September, keeping the months of supply below two months.

While conditions remain relatively tight, purchasers are more cautious than they were earlier this year, causing monthly prices to ease by nearly two per cent. Despite the downward trend recorded over the past four months, prices remain over 12 per cent higher than last year.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

|