Detached

For the third month in a row, sales levels in the detached market have eased. Much of the pullback has occurred from homes priced under $600,000. While some of this is likely related to the continued lack of supply choice, the pullback in this sector is also related to the rise in lending rates that are impacting qualifications levels and creating some hesitancy among consumers.

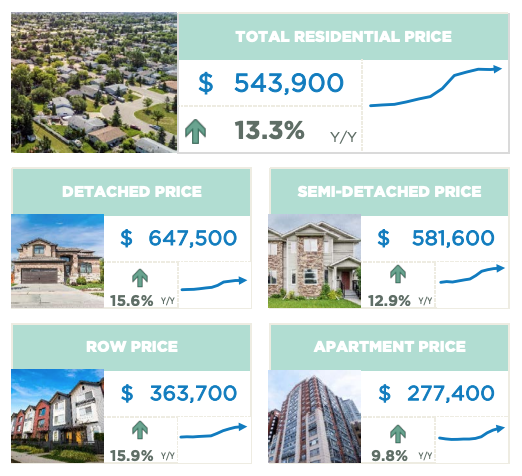

The pullback in sales relative to new listings did cause some modest gains in inventory levels compared to earlier in the year. This helped push up the months of supply to just under two months. The shift to more balanced conditions has been limiting the upward pressure on prices. As of June, the benchmark price was $647,500. This is comparable to last month, but still 16 per cent higher than last year.

Semi-Detached

Like the detached sector, sales activity slowed in June. While the pullback in sales was not enough to offset earlier gains, it was enough to push the months of supply up to nearly two months. While this gain in months of supply is likely welcome news for some buyers, conditions still remain tight compared to what we traditionally see in this segment of the market.

Prices also saw some adjustment this month easing slightly relative to May’s levels. This was mostly due to adjustments in the North East, East, North West, North and South East districts of the city. However, with a benchmark price of $581,600, prices in Calgary remain nearly 13 per cent higher than levels reported last year.

Row

Unlike the detached and semi-detached sector, row sales activity improved and reached a new record high for the month of June. The row market tends to offer a more affordable option for consumers compared to both semi-detached and detached homes. While new listings did improve relative to levels recorded last year, it was not enough to offset the gains in sales. As a result, inventories trended down and the months of supply remained relatively tight at one and a half months.

The benchmark price still recorded some modest gains this month, but the pace of growth slowed down significantly compared to earlier in the year. Overall, the benchmark price reached $363,700, nearly 16 per cent higher than last year.

Apartment Condominium

While apartment condominium sales continued to slow from record levels reported earlier in the year, sales were still over 31 per cent higher than levels reported last year. This in part was possible due to the recent boost in new listings. At the same time, the boost in new listings did help take some of the supply pressure off this market as the sales-to-new-listings ratio eased to 62 per cent and the months of supply pushed up to nearly three months.

The shift to more balanced conditions is also helping slow the pace of price growth in this market, but not completely disrupt it. The benchmark price in June reached $277,400, nearly one per cent higher than last month and 10 per cent higher than last year’s levels. Despite these gains, prices continued to remain below 2014 highs.

REGIONAL MARKET FACTS

Airdrie

Sales in June continued to ease from levels reported earlier in the year and levels achieved last year. However, the decline was not enough to offset earlier gains as year-to-date sales remain over 24 per cent above last year’s levels. While new listings did improve compared to last year, levels were not enough to significantly alter the tight market conditions in Airdrie. The sales-to-new-listings ratio remained relatively tight at 81 per cent and the months of supply, while higher than earlier in the year, pushed just slightly above one month.

Earlier in the year, Airdrie reported some of the highest monthly price gains ever seen in the market, so as interest rates rise and consumers take a step back to reevaluate conditions, it is not a surprise that we are seeing some adjustments in price. While prices have trended down for the past two months, they remain over 22 per cent higher than levels reported last year.

Cochrane

Easing sales this month contributed to year-to-date sales of 735 units, just slightly higher than levels reported last year. So far this year, the growth in new listings has outpaced the growth in sales and it has helped push up inventory levels relative to what was available in the market earlier in the year. This also helped push the months of supply back above one month, something that has not happened since October of last year.

While conditions remain far from balanced, the slight shift has taken some of the pressure off home prices which reported strong monthly gains earlier in the year. The benchmark price in June rose to $522,600, a slight gain over last month and nearly 18 per cent higher than prices recorded last year.

Okotoks

Sales activity remained relatively stable this month supporting year-to-date sales of 544 units, just slightly higher than levels reported last year. At the same time, new listings have also remained relatively consistent with last year’s levels. This is leaving the market to continue to favour the buyer with one month of supply and a sales-to-new listings ratio of 80 per cent.

Despite tight conditions, there was a modest pull back in the monthly price. However, with a benchmark price of $556,200, prices remain nearly 17 per cent higher than levels reported last year.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

|